It’s Thursday, and today we’re focusing on BRKZ, a Saudi company in the construction sector that recently secured a $17 million round from Capifly, Fluent Ventures, BECO Capital, Aramco’s Waed, Class 5 Global, Knollwood Investment Advisory, Better Tomorrow Ventures, 9900 Capital, MISY Ventures, and RZM Investment.

The Product

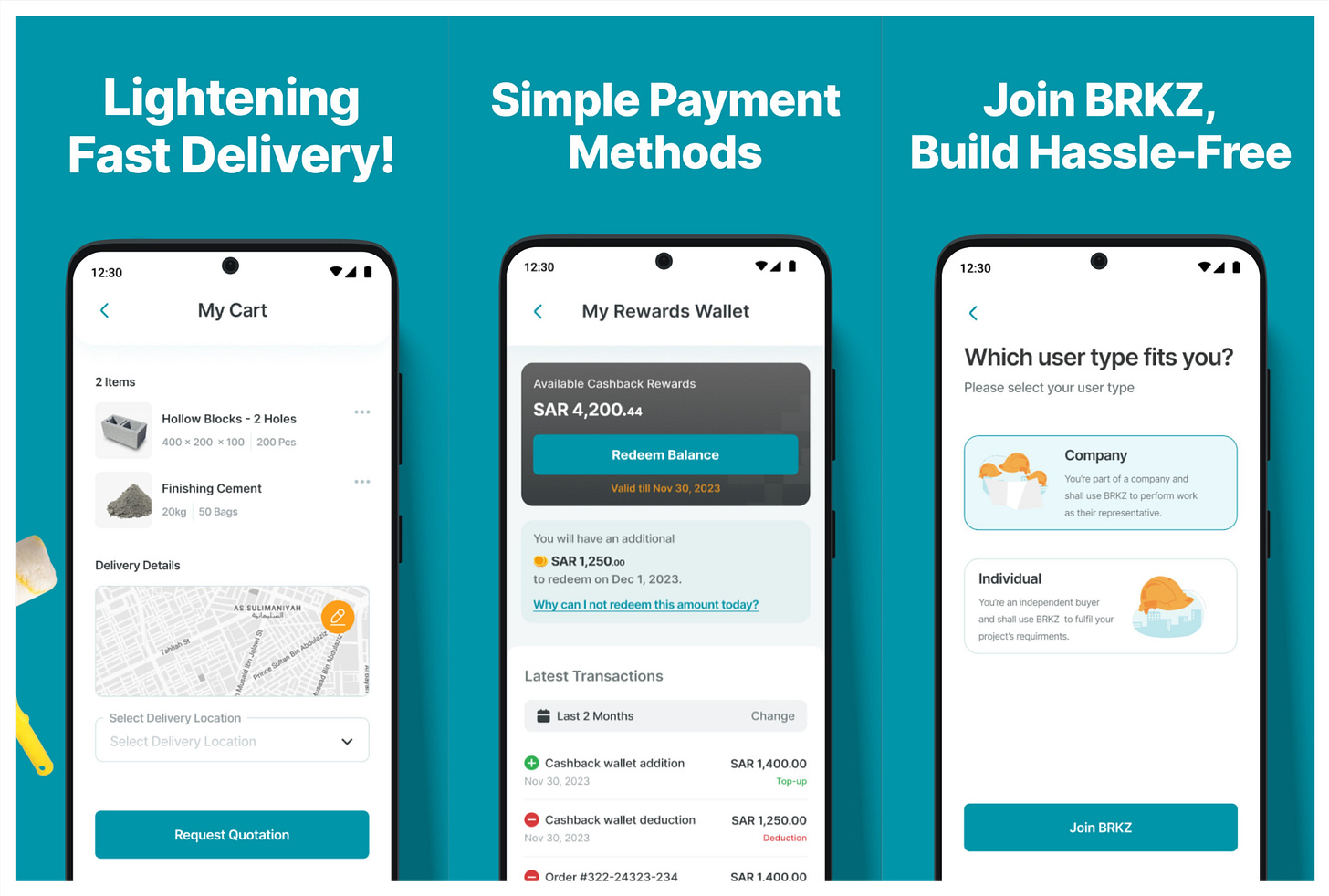

BRKZ is a B2B marketplace selling construction materials, like cement and steel rebars. As with most marketplaces, BRKZ’s offering is fairly straightforward: as a customer, you get lower prices and a wide selection, and as a business, you get access to a growing customer base all over the country.

Over the last year, BRKZ expanded its offerings from 1,200 SKUs and 350 suppliers to more than 7,000 SKUs and 1,100 suppliers, who now compete for 250 contractors active on the platform. Orders are transported by 500 partner logistics providers delivering across 40 cities.

On the customer side, everything is simple. You go to the platform and select the products you need. Then, you send a quotation request via WhatsApp, the website, or the app, and within 30 minutes, you get your pricing options. Once the offer is accepted, BRKZ processes it and delivers it on the same day. Customers can pay via cash, bank transfer, buy-now-pay-later (BNPL), or Mada POS, a local payment system.

Since its launch in 2022, BRKZ processed over $170 million in quotations by March 2024. Less than a year later, that number has grown to $350 million — more than double.

The Business Model

BRKZ started out as a sort of middleman between buyers (usually contractors) and sellers (manufacturers or distributors). In this setup, transaction fees paid by suppliers were the primary revenue source. And while I haven’t worked with the construction industry in Saudi Arabia, from experience, this isn’t the most lucrative business model.

What is lucrative, though, is financing — and that’s where BRKZ is making a strategic move with its BNPL solution. To apply, you go to the website, fill out a form, wait three days for approval, and if approved, you can buy what you need and pay in installments. The three payment options are:

50% upfront, 50% after 30 days

33% in three installments over 60 days

25% in four installments over 90 days

That’s the financing side.

Next, BRKZ launched its own brand of binding wires, which presumably have much better margins than transaction fees.

In the future, the company aims to move into inventory management and become a full end-to-end construction marketplace — not just providing materials but also manpower, equipment, and subcontractors. Additionally, BRKZ is targeting expansion into hard-to-source materials, starting with China this year.

The Local Angles

Saudi Arabia’s construction plans resemble China’s construction boom in past decades — except somehow on a smaller and a bigger scale at the same time.

Potentially Enormous Opportunity: BRKZ operates in a market that could see unprecedented expansion. The boom is driven by Saudi’s megaprojects, headlined by Neom — a plan to build 10 futuristic cities and the $500 billion centerpiece of Vision 2030. Neom, along with 13 other ‘giga projects,’ is worth a combined $2.5–3 trillion. On top of that, Saudi Arabia is hosting Expo 2030 and the FIFA World Cup in 2034. Considering Qatar’s World Cup cost $220 billion, and the fact that one of the five Saudi cities where matches will be played doesn’t even exist yet, the total cost will likely be much higher. Current projections suggest Saudi Arabia’s construction market will reach $181.5 billion by 2030 — almost 30% more than in 2023.

Supplemental Drivers: Megaprojects aren’t the only force driving growth. Vision 2030 aims to increase homeownership to 70%, already up to 63%. The mortgage market, which between 2016 and 2023 grew by 426%, was a big enabler. There’s also a $22.5 billion metro expansion and a $235 billion investment in renewable energy by 2030.

Fragmented Industry: The market has a huge number of sellers — manufacturers, distributors, wholesalers, etc. There are over 150,000 building and construction companies in the country. In the cement industry alone, no single player has over 12% market share, and 16 companies each control at least 2%. Since cement is one of the most commoditized products out there, suppliers mainly compete on two things: price and speed — which makes a marketplace like BRKZ a natural fit.

The Roadblocks

There are some competitive pressures, potential scaling issues, and supply chain constraints. But for me, the two biggest risks are:

Troubles With Megaprojects: Saudi Arabia’s ambition is off the charts. Those $500 billion for Neom? That’s 50% more than the country’s entire federal budget. And some estimates put the true cost of Neom at $2 trillion. Projects are already running behind schedule — take The Line, the 170km-long linear city. By 2030, only 2.4km will be completed. At that pace, we’ll see the full 170km version sometime in the 2700s. Not ideal. If megaprojects stall or get scaled back, what happens to BRKZ’s market?

A Business Model Around Financing: Financing works great when the industry is booming. But if the government struggles to fund megaprojects — delaying payments to BRKZ’s buyers — how does BRKZ handle liquidity strains? Raising more money is an option, but in an industry-wide downturn, that gets tricky.

The Takeaway

What stands out to me is the weird discrepancy here: on one hand, you’ve got trillions of dollars in projects; on the other, the construction industry itself is still super fragmented. BRKZ is basically the first company trying to structure and coordinate it. Whether they succeed depends on how well Saudi Arabia keeps up its breakneck pace.