It’s Thursday, and today we’re focusing on bukaPO, an Indonesian culinary marketplace that recently closed a seed funding round led by Bali Investment Club and elea Foundation for Ethics in Globalization.

The Product

As a marketplace, bukaPO connects over 4,000 home chefs with individual customers and businesses. Imagine Etsy, but for food—that’s basically what bukaPO is.

Since the chefs are locals (90% are women, mostly micro-businesses), the food tends to be local as well. Through bukaPO, you can order dishes like pempek—a desert made from fishcake and tapioca—or if you’re in the mood for something more familiar, a rice bowl with chicken teriyaki.

The menu itself doesn’t look very fancy, but I think that’s kind of the point. If it were posh, it wouldn’t feel like authentic home cooking.

Ordering works just like on any other site: pick your dishes, add them to the cart, pay, and wait. It’s the “wait” part where bukaPO’s business model gets interesting.

The Business Model

Since bukaPO’s suppliers are micro-businesses without the capital or scale to offer ready-to-cook meals, the company leverages a pre-ordering model to connect home-based culinary entrepreneurs with customers.

What exactly does that mean?

In traditional food delivery, you order your food and receive it within 30-60 minutes. With bukaPO, you get it the next day. Specifically, if your order is placed before 19:00, you receive it at least one day later. If ordered after 19:00, expect it at least two days later. For customers, the downside here is obvious, but it significantly helps the vendors:

Low financial risk—vendors don’t need to buy ingredients in bulk, hire extra staff, or purchase additional kitchenware. You get the order—you buy the ingredients.

Supplemental income—vendors don’t need to stand by waiting for orders. They can hold regular jobs and fulfill orders in their free time.

Better quality control—vendors aren’t forced to rush cooking or compromise on quality. They have enough time to source fresh ingredients.

Guaranteed income—orders can’t be canceled or returned, so vendors get paid unless they themselves cancel due to product availability issues or similar reasons.

Once an order is placed, the vendor has at least a day to prepare it. bukaPO’s logistics partner handles delivery within two fixed time windows (11:00 or 15:00), while packaging and quality control are the vendor’s responsibilities.

Now, onto the money.

Vendors set their own prices, though bukaPO runs many promotions vendors can participate in if they want. Payments are made upfront during checkout—no cash options. On the bright side, bukaPO offers an extensive cashback reward system: customers earn points for signing up, referring friends, reviewing products, or completing surveys. These points can only be used within the platform, encouraging repeat purchases.

bukaPO takes a 12.5% commission on every order. Since customers pay immediately but vendors receive payouts once a week, bukaPO temporarily holds a float. In theory, this float could be leveraged for short-term investments or to offer credit to merchants,

The Local Angle

A land of small food businesses

SMEs contribute 61% of Indonesia’s GDP (compared to 43.5% in the US). The informal sector alone accounts for 36% of the country’s GDP and employs 59% of the workforce. Food is one of the sectors where small, often informal businesses dominate. Estimates suggest there are around 2-2.2 million home-based food and beverage businesses in Indonesia, thanks to low barriers to entry, a large addressable market, and unique home recipes.

This abundance of options, combined with a widespread use of delivery apps, has deeply embedded food delivery into local culture. 74% of Indonesians use food delivery services at least once a month, and some estimates suggest families order around 30% of their meals. Overall, the food delivery industry has reached $5.5 billion and is growing at 18% annually.

The love for discounts, promotions, and cashbacks

bukaPO’s website is full of promotions, and for good reason: Indonesians love them.

Promos and discounts—not convenience—are the main driver for choosing food delivery services. When selecting a delivery provider, 36% prioritize available discounts and promos, with only 28% considering delivery costs, and just 15% prioritizing speed.

A study showed cashback as the primary driver behind the popularity of ShopeePay, a popular mobile wallet in Southeast Asia. Other research concluded that cashback promotions heavily influence impulse buying.

So yes, promos matter—a lot.

Culinary diversity

Indonesia’s culinary diversity is driven by two main factors. First, the country hosts 1,331 ethnic groups spread across 17,000 islands, each with unique histories, languages, and traditions. Second, Indonesia has incredible food-source diversity. It produces the second most diverse selection of food globally, trailing only Brazil, including 77 carbohydrate varieties, 75 fats, 389 fruits, and 228 vegetables.

This diversity appears in two ways. One, the sheer range of available dishes: for instance, Soto, a traditional Indonesian soup, alone has 75 variations. Two, the complexity: Indonesian dishes typically contain around ten ingredients, underscoring culinary richness.

The Roadblocks

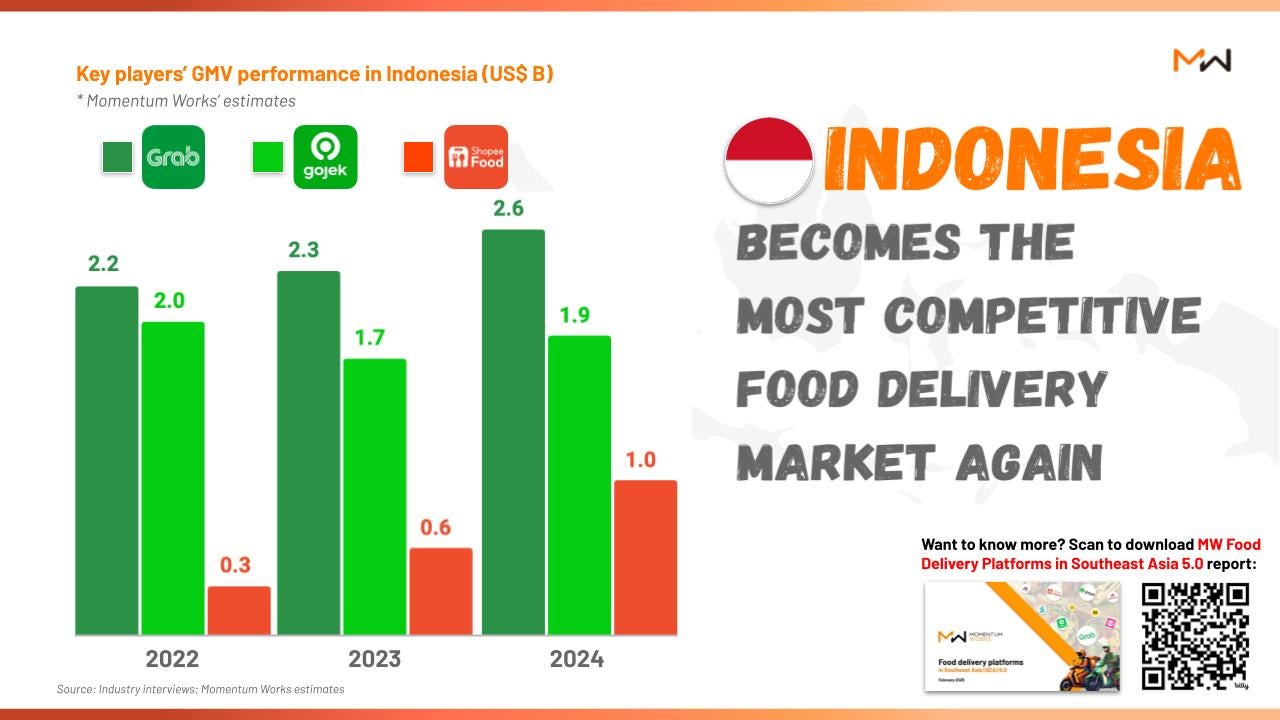

Aggregators dominate

There’s a lot that could be written about the roles that GoTo, Grab, and Shopee play in the Southeast Asian digital economy. But for our purposes, we just need to acknowledge the dominance these three platforms hold. They’ve aggregated both demand and supply, and now essentially drive the market. Without an inherent advantage, it’s very tough for any newcomer to compete.

Delivery times

Next-day delivery automatically limits bukaPO’s ability to serve the largest segment of the market—people who want to eat here and now. A significant problem with pre-ordering is that I know what I want now and order accordingly, but I have no idea if I’ll want the same dish tomorrow. And since there’s no way to modify the order afterward, I might end up disappointed—not because the food’s bad, but because my preferences changed.

Another problem is the fixed delivery windows. To receive my order, I have to be at a specific place at a specific time. This isn’t much of an issue when food arrives within 40 minutes, but it’s far less convenient when it’s 24 hours later.

Trust and quality control

bukaPO is explicit that quality control is the vendor’s responsibility. But honestly, if a customer gets food poisoning, they’re not going to care whose fault it technically is. When dealing with Pizza Hut, both customers and platforms rely on the brand’s strict standards. But with mom-and-pop shops, it’s a different story. You might hope for the best, but you never really know.

And this is speculative, but I also think that if you get food poisoning from Pizza Hut, it’s easier to let it slide—you know millions eat there daily without issues. But when an unknown cook sends you a dish, you have no idea how many other dishes they’ve delivered safely, which could amplify customer doubts.

Scaling challenges

Every marketplace faces challenges in aggregating supply and demand. In bukaPO’s case, these challenges are heightened by how fragmented the supply side is—perhaps just as fragmented as demand. We don’t know what percentage of the 4,000 vendors on the platform operate full-time, but it’s probably not all of them. Scaling bukaPO to tens of millions in revenue would therefore mean onboarding thousands of additional vendors.

Thin margins

While having lower commissions compared to delivery giants is beneficial to both consumers and vendors, commissions are what keep marketplaces afloat. From the 12.5% bukaPO makes on each order, they have to cover staff salaries, tech infrastructure, and payments to delivery partners. There’s not much wiggle room.

The Upside

A nobel mission

We talked earlier about how massive Indonesia’s small-business sector is. bukaPO strongly positions itself as an enabler of micro and small businesses. The company was founded during the pandemic specifically to help local businesses overcome tough times, and both lead investors in their recent funding round are impact-driven. As the company scales, I think this mission can greatly help bukaPO in messaging, recruiting like-minded talent, and maintaining strategic clarity.

Easy to acquire merchants

Although bukaPO obviously needs to continually onboard merchants, I don’t think actually converting them onto the platform is difficult. The rules are very merchant-friendly, and I suspect most vendors don’t already have a digital storefront, making bukaPO an attractive option.

Bali focus

While bukaPO operates in East Java, their main market is Bali. Given Bali’s popularity with tourists and expats, I suspect food delivery is significantly more popular there than on other islands. Plus, Bali isn’t particularly large (5,590 sq km), making marketing—even offline—much simpler.

The growing tide lifts all boats

The digital economy, the food delivery sector, and Indonesia’s middle class are all rapidly growing. bukaPO has plenty of opportunities to capitalize on these trends.

The Takeaway

I genuinely didn’t know that pre-ordering meals even existed for individual consumers. Even if I’d known, I’d have assumed it mainly appealed to corporate clients, not regular people. bukaPO’s model proves otherwise.

I also appreciate bukaPO’s pro-vendor angle. Usually, aggregators prioritize the consumer—because consumers almost always have alternatives. Vendors, on the other hand, often have limited choices. It’s intriguing to see a marketplace tilt the other way for once.

Also, I’m hungry.