It’s Tuesday, and today we’re zooming in on Cutstruct, a Nigerian construction tech company. Founded by John Oamen and Tayo Odunsi, the company just announced a $1.5 million seed round led by CRE Venture Capital, with participation from E3 Capital, Techstars, and Zedcrest.

The Product

Most companies evolve from simple to complex. The first version of the product does one thing well. Then, over time, as they grow revenue and dive deeper into customer problems, their offering becomes more sophisticated.

Cutstruct seems to have done the opposite.

So what is Cutstruct?

It makes sourcing construction materials in Nigeria easier, faster, and more reliable. Cutstruct simplifies procurement by connecting developers and contractors with vetted suppliers (manufacturers, distributors) and layering on services like transport, insurance, and credit.

That’s the pitch. But how that pitch is delivered has changed over time.

Back in 2020, the company offered three distinct platform solutions:

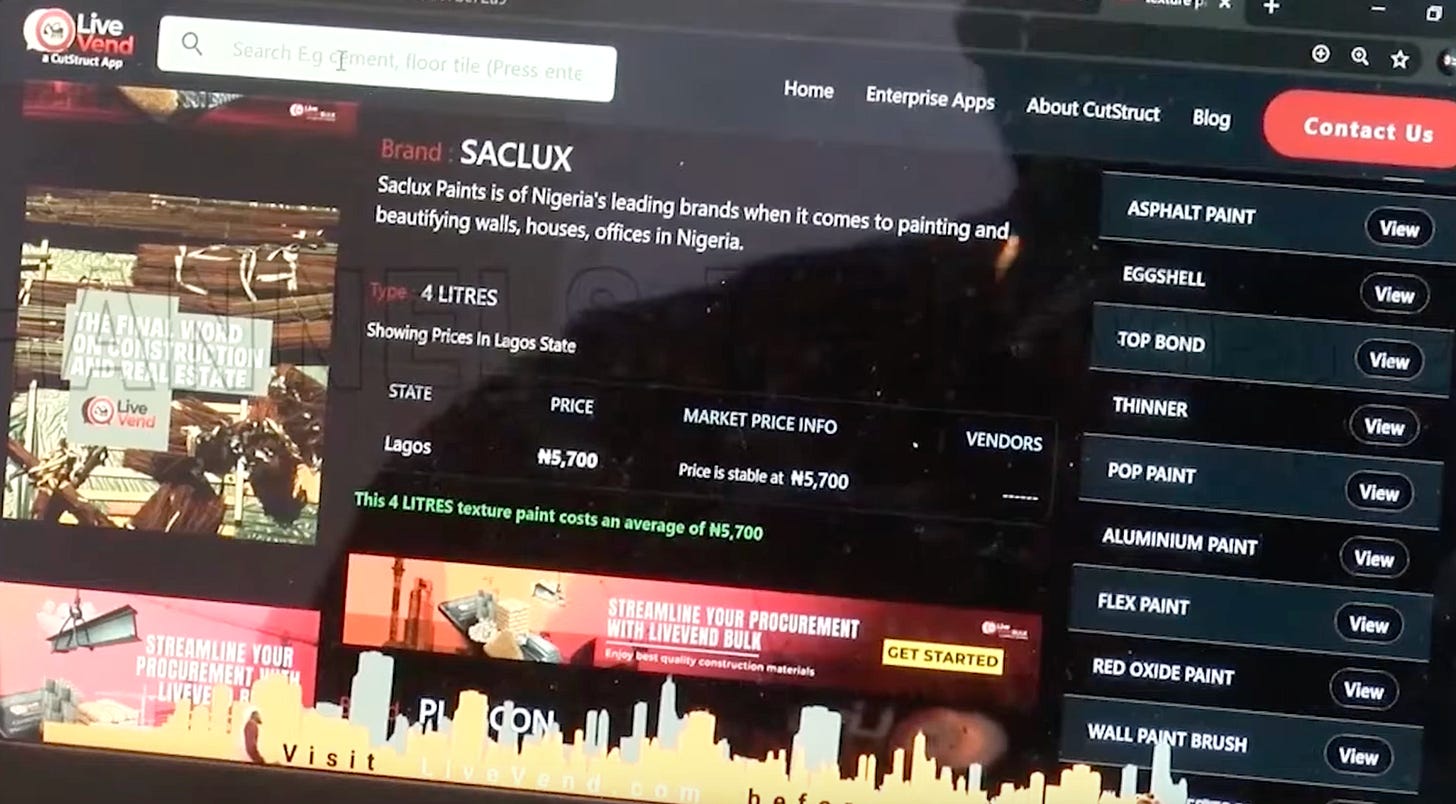

LiveVend — a place for buyers to discover material prices.

LiveVend Bulk — a procurement tool for managing and analyzing project expenses.

LiveVend Pro — a dashboard to track all your construction projects.

At the time, the company claimed to have onboarded 800 vendors and supported projects worth a combined $1.5 million.

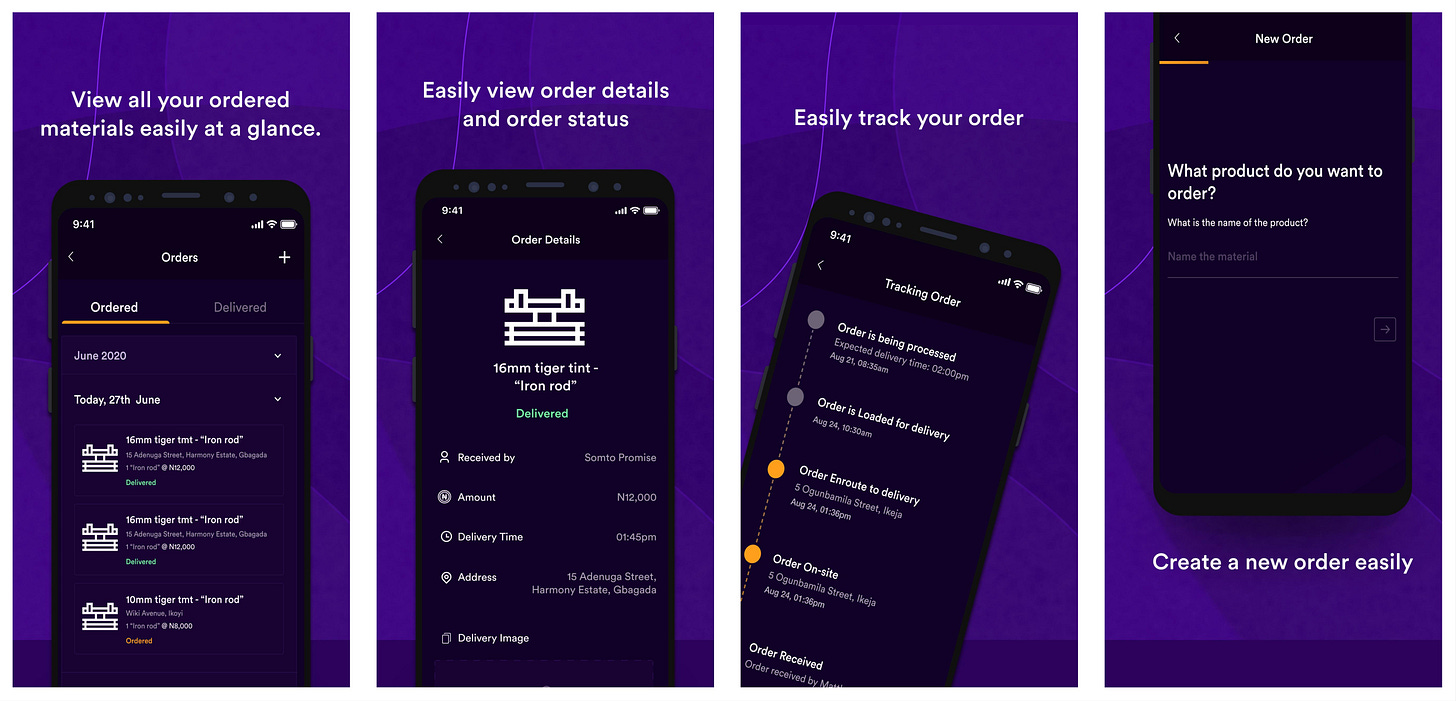

It wasn’t just a website—LiveVend Bulk even had an Android app. You can see what it looked like here:

That app was last updated in 2021—and today, it no longer exists.

From what I can tell, Cutstruct made the decision to consolidate. Rather than maintain three separate products, they streamlined everything into a single platform: LiveVend.com.

Through this platform, you could find the materials you needed, get transparent pricing, access financing, and arrange delivery.

But things have changed again — and the product has been radically simplified. Now, every enquiry runs through WhatsApp. You visit Cutstruct’s website, click to launch a chat, and send your delivery address, material specs, and quantities. A Cutstruct manager takes it from there—finding you the best supplier with detailed pricing and quality comparisons.

As the company told me, WhatsApp is just a bridge. LiveVend is being quietly rebuilt in the background and, unlike previously, you can’t just go and visit the website. But maybe that’s fine. Maybe clients don’t need a full-blown platform. At the end of the day, they don’t care about the product—they care about the result. If it delivers the right materials at the right time, that’s all that matters.

The Business Model

That said, the platform will return—and if past experience is any guide, it’ll work like a classic marketplace. The more buyers it attracts, the more appealing it becomes to suppliers, which in turn brings in more buyers. That flywheel eventually weeds out low-quality suppliers. That’s the core of the product.

The infrastructure around that flywheel is built through partnerships. Back in 2022, those included: Axa Mansard (insurance), Sterling Bank (material financing), Apel Trustees (escrow), VerifyMe (vendor vetting), and Greychapel Legal (legal structuring). More recently, Cutstruct partnered with Salad Africa to offer flexible credit.

The specific partnerships may shift over time; however, the idea behind them stays the same: Cutstruct acts as a stable middleman, bringing in partners to provide ancillary services that enable buyers to execute transactions and be confident in those transactions.

Monetization

Cutstruct makes money through commissions: it takes 3–15% from manufacturers or distributors per transaction. They’ve also mentioned earning 2–4% on currency spread for imported materials, and a 2% commission on financing—but those seem to be on pause for now.

The Local Angle

Cost overruns

The Nigerian construction business is incredibly inefficient. Although estimates vary, between 45% and 70% of construction projects experience cost overruns. Moreover, three-quarters of projects exceed their initial budgets.

There are many reasons why costs spiral out of control. One study identified 19 factors, while another counted 32. Regardless of the exact number, most studies agree that four key factors consistently drive costs up:

Inadequate financing: both clients and suppliers struggle to access the most efficient forms of financing.

Material price inflation: not only can prices rise rapidly, but they can also fluctuate significantly between suppliers, who differ in market power, stock levels, and sourcing.

Design variations: design changes — or errors in the original design — often lead to excess material purchases, which in turn fuel cost overruns.

Risk and uncertainty: builders frequently underestimate the likelihood of disruptions and fail to manage risk effectively.

Cutstruct can’t solve all macroeconomic problems. But it can reduce risks at the transactional level — like when a supplier gets paid but doesn’t deliver, or when they inflate prices because the client lacks access to alternative sources.

Hyper-volatile input prices

I want to zoom in on the pricing issue, because it’s not only central to the realities on the ground, but also to Cutstruct’s business model.

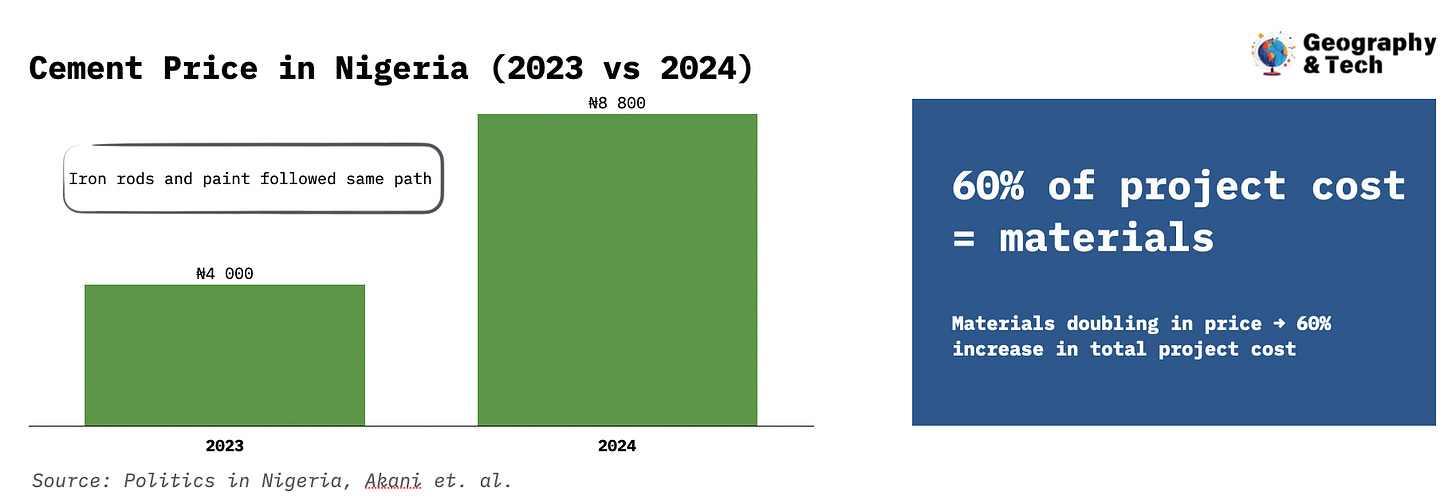

In 2024, the price of cement doubled from ₦4,000 to ₦8,800 per bag in just 12 months. Iron rods and paint followed a similar trajectory. Depending on the project type, material costs can account for up to 60% of total project costs. If material prices double and we assume materials contribute 60% to the total cost, that alone implies a 60% increase in project costs within a year. Yes, this is a rough estimate with many assumptions — but the general point holds.

There are many reasons for these price hikes, the main one being the depreciation of the naira. With 90% of construction materials being imported — which, frankly, baffles how is that even possible for the fourth-largest economy on the continent — naira depreciation inevitably leads to price increases.

By increasing market supply, Cutstruct gives builders more options — something that can indirectly ease price pressure. It’s not a fix for inflation, but it can make material costs a little less volatile.

Supplier quality

As we’ve established, Nigeria’s construction sector is underdeveloped — and much of that comes down to supplier quality. Three things determine how good a supplier really is:

Brand recognition: are these suppliers known and trusted by buyers?

Product quality: will buyers sleep well knowing the materials used in their project won’t lead to disaster?

Delivery reliability: are shipments timely and consistent?

Across all three areas, the industry struggles.

Starting with recognition: there are thousands of suppliers in the market. Many are virtually unknown, operating on razor-thin margins and reselling third-party products. It’s no surprise that some cut corners.

Then there’s product quality. One study found that 10.6% of building collapses were caused by substandard materials. A study by Nigeria’s House of Representatives claims that 56% of all collapses result from poor materials and cheap labor.

Lastly, delivery reliability. Research from Abuja and Lagos identified material shortages and shipment delays as major contributors to poor construction site performance. Another paper notes that average truck dwell time in North-Central Nigeria was 14 hours at depots and project sites — with 87% of vehicles lacking tracking or integration tech.

Cutstruct tackles all three challenges by onboarding vetted, reliable suppliers who can be trusted to deliver quality materials to the right place, on time.

The Roadblocks

Issues outside of Cutstruct’s control

A large part of the construction industry operates under conditions that Cutstruct simply can’t influence. While the company might find ways to partially cushion the impact of currency fluctuations — we’ll touch on that in a minute — it’s not a central bank. These macro-level issues affect everyone in the industry, so Cutstruct won’t lose business to a competitor because of them. But they can slow business down. The same goes for road collapses, sudden regulation changes, or other systemic infrastructure issues.

Supplier crunch

Some suppliers may be reluctant to join Cutstruct’s network because they don’t want to embrace transparency — open bidding compresses their margins. Others may be difficult to onboard due to regional differences in how the industry operates. And some simply won’t meet the quality threshold. All of this narrows the pool of onboarded suppliers, which limits the strength of the marketplace model.

Trust

How much will builders trust a middleman? How willing are they to buy materials through a not-so-well-known intermediary? Cutstruct is in the business of selling trust — but to scale that, it first has to earn it. And it’s doing so in a sector that is largely offline, under-digitized, and skeptical by nature.

The Upside

Products for stabilizing prices

If (when) the platform piece comes back, there’s huge potential in building tools that offer price stability. These could range from simple price locks for 48–72 hours, or small premiums (say, 1–2%) in exchange for fixed prices over 30–60 days, to more advanced features like price increase alerts and fixed exchange rates for select commodities. There’s also major upside in expanding the financing arm of the business.

Need for construction

With Nigeria’s crazy population growth, there’s an urgent demand for housing, office space, and industrial facilities to accommodate the millions of young people entering the workforce. Most countries experience a construction boom once in a generation — if ever. But in Nigeria’s case, construction is already growing faster than the economy itself, and it will have to continue doing so to keep pace with demographic pressures.

Regional expansion

Cutstruct is operating in one of the most challenging emerging markets. But while Nigeria is the biggest, it’s far from the only one. The company already talks about its vision for international expansion, and there’s plenty of opportunity beyond Nigeria’s borders. Supply chain inefficiencies in construction are just as real in Ghana, Kenya, and Côte d’Ivoire. Although Cutstruct will need to build a local supplier network, the approach to doing so will be similar.

The Takeaway

I’ll leave you with two thoughts.

First, it’s interesting to see product simplification taking place. We’re seeing it in both developed and developing markets—especially with all the AI innovation. Which makes a lot of sense. In a perfect world, you don’t need a convoluted interface to execute a task. You press a button, and the task is done.

Second, this is vaguely related to the article, but not entirely.

There’s a good book called The Next Factory of the World, which explores the idea of Africa becoming the world’s next manufacturing hub after China. It tells the story of Mr. Sun, who, after a visit to Nigeria, asked himself: what’s the most promising product to manufacture locally? Back in China, he called a contact at the customs authority and asked, “What is the physically heaviest product being shipped in large quantities to Nigeria?” The answer: ceramics. So he built a ceramic tile factory in Nigeria.

After writing this article and reading that book, I can’t help but wonder: why aren’t more local and foreign entrepreneurs manufacturing construction materials in Nigeria instead of importing them? Sure, there are major barriers — inadequate financing, unreliable electricity, poor infrastructure — but can it really be worse than paying double what you paid for materials just a year ago?