This is a special issue for me. Probably the combination country/industry that I wanted to dive into the most was India's quick commerce.

Today I finally get the opportunity to do exactly that.

We are discussing KiranaPro, an Indian startup looking to disrupt how things are done in traditional quick commerce. The company recently raised an undisclosed investment from India's badminton star PV Sindhu, and in December KiranaPro secured a pre-seed funding round from TurboStart, Unpopular Ventures, Blume Founders Fund, and Snow Leopard Ventures, and several angel investors.

PSA: Since this one is quite a bit longer than usual, this week we'll skip the Thursday post, but we'll be back to our regular scheduled programming next week!

The Product

One of KiranaPro's investors, Angad Daryani, gave a concise and precise description of what KiranaPro is and what it is trying to solve:

KiranaPro is trying to give a second life to 13 million Kirana Stores (Grocery Stores) by enabling them to serve customers via 10 minute quick-commerce deliveries on the ONDC platform. If successful, the company would have saved 13 million families from going out of business. Imagine Zepto/Blinkit without their dark warehouses.

There's a lot to unpack there, and we'll address all the points made in this short passage. But let's start by very quickly defining two terms: kirana stores and quick commerce:

Kirana stores—small, family-owned neighborhood grocery shops common in India, typically offering essential groceries and household items, characterized by personal relationships with customers.

Quick commerce—an ultra-fast delivery model focusing on rapid (under 30 minutes) delivery of small grocery orders or essentials, primarily through app-based services using localized warehouses or dark stores.

KiranaPro is helping the first to disrupt the second.

How is it going about that?

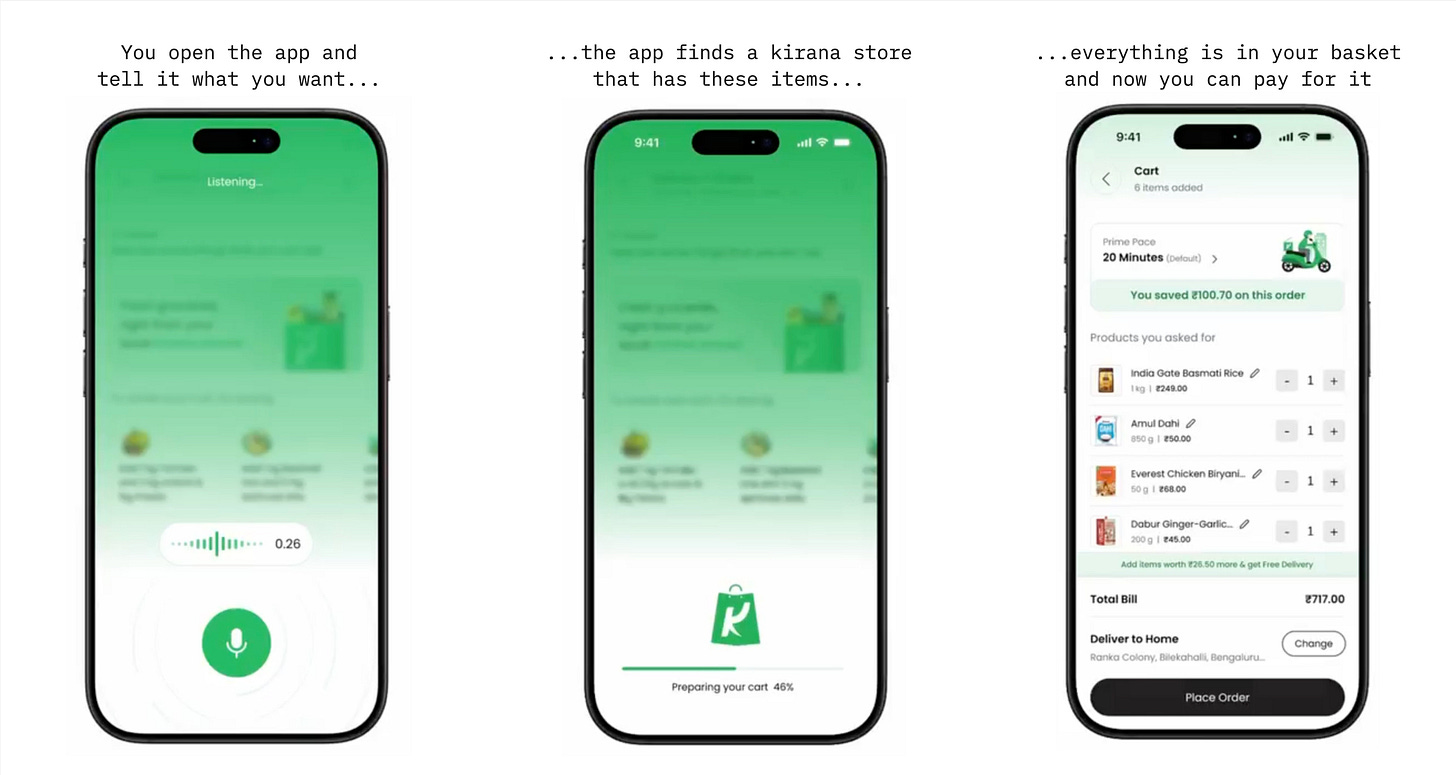

KiranaPro is a consumer-facing app that helps customers find and buy essential items in kirana stores and get them delivered to their home in under 30 minutes. You do that through an AI-powered voice agent: you open the app, name the products that you want, and then just pay for the stuff.

And yes, you do that through voice, not search. There's no traditional catalog or search function. You can't use the app as you would use Amazon or any other e-commerce app or website. It's all voice-enabled with the app supporting 37 languages.

Why only voice search? KiranaPro's pitch is that traditional catalogs will go away. In the future, the customer will just open whatever app they're using, name the things they want, and that's it. Since far from all of India's population are e-commerce buyers, many of them will never experience a store with a catalog.

The founders think of shopping as a job-to-be-done, not as a list of things you want to purchase:

Think of it like a web agent that's basically listening to the shopkeeper. While on the other side, the consumer has a goal in mind. They want to buy snacks for a party of 20 people under a budget of 1000 rupees. That's the kind of things that people are trying to solve for themselves. They're not really trying to solve for like, five packets of chips and two bottles of coke.

Obviously, you can still tell the app to buy chips and coke, but the idea here is that in the long run, you wouldn’t have to. With how far LLMs have come, you could imagine a future where you just talk to the app in a casual, unstructured way, and it still puts the right items in your basket.

In a perfect world, you’d just say, “Today I’m making a Caesar salad”, and in ten minutes, all the ingredients are on your kitchen table.

One more thing to mention on the product side: technically, the company has already onboarded 30,000 stores and is available all across India.

Here’s how.

The Business Model

We’ve quickly arrived at the fun part.

Anyone who’s been paying attention knows that quick commerce is exploding and its players are incredibly well-funded. So how can KiranaPro threaten their business?

There are two pieces to the model that make this possible.

Piece #1 — ONDC

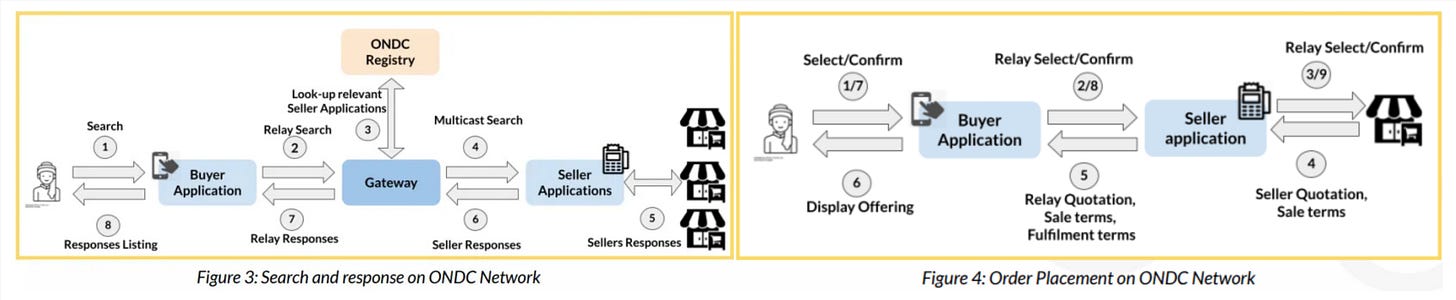

The Open Network for Digital Commerce (ONDC) is the foundation of everything.

ONDC is a government-backed initiative to decentralize e-commerce. Think of it as a massive open marketplace connecting many smaller marketplaces, allowing buyers and sellers to find each other easily—without relying on giant e-commerce companies.

The platform unbundles every part of e-commerce—search, ordering, fulfillment—into independent, interconnected blocks.

Sellers, from major retailers to kirana stores, can showcase their products or services. Buyers can discover those products across multiple apps and websites.

So unlike traditional marketplaces, KiranaPro doesn’t need to worry about finding suppliers—the supply is already onboarded by sell-side apps. It doesn’t have to build a fulfillment and logistics network—it’s already there. Same with payments. All the apps in the ONDC network ‘talk’ to each other through APIs.

There’s a great article by Rahul Sanghi from Tigerfeathers if you want to go deeper into ONDC.

What’s important for us, KiranaPro only needs to focus on two things:

How to acquire and onboard customers.

How to retain them.

That’s it. Everything else is abstracted away.

Piece #2 — The anti-quick commerce strategy

We’ll discuss how formidable quick commerce is in the next section, but first—this is where KiranaPro shines.

A lot of businesses see a booming industry and think, “Great! I’ll just copy what the other guy is doing and be successful.” But copying rarely works unless you have a built-in advantage.

So instead of going head-to-head with quick commerce, KiranaPro does the opposite:

Geographic targeting: uick commerce focuses on Tier 1 cities (India’s biggest metros). KiranaPro, while launching in Bangalore, targets smaller cities and is technically available everywhere—because it doesn’t onboard sellers; sell-side apps do.

Order fulfilment: Quick commerce runs on dark stores. A new city means building dark stores, which service a 2-3 km radius, plus a mother warehouse to supply 30-40 dark stores per city. Each dark store serves thousands of households. KiranaPro works through local kirana stores, each serving 100-200 households and stocking goods independently.

Last-mile delivery: Quick commerce usually operates its own delivery fleet (though models vary). KiranaPro uses ONDC partners for deliveries.

Product selection: Quick commerce stocks 6,000+ items in its dark stores. Kirana stores carry 1,000-1,500 items—not as much variety, but each store curates its own assortment.

Monetization: Quick commerce monetizes primarily through order and a delivery fee. KiranaPro’s original monetization plan was also order fees (i.e. percentage on top of kirana store’s price) or through a SaaS offering. But now the team quickly pivoted to advertising. Quick commerce players are also launching ads, but for now it’s not their focus monetization scheme.

Capital requirements and scalability: Quick commerce is asset-heavy—warehouses, dark stores, delivery fleets. KiranaPro is asset-light: no owned stores, no delivery drivers, just the app.

Jeff Bezos has a famous quote about making your beer taste better. I won’t get into the analogy, but his point was: focus on the product, and on the parts that creates value for the customer. Let someone else handle everything else.

In this case, take fulfilment. For quick commerce, each dark store means managing inventory, selecting assortment, optimizing space, and tracking riders.

KiranaPro doesn’t do all that for fulfilment or any other back-end operations.

They’re definitely focused on making their beer taste better.

The Local Angle

To understand what makes this industry so special, let’s first highlight the explosive growth of quick commerce—then we’ll get into why India is the place for it to thrive.

Quick commerce’s unprecedented growth

When it comes to quick commerce, pretty much every stat you look at blows your mind:

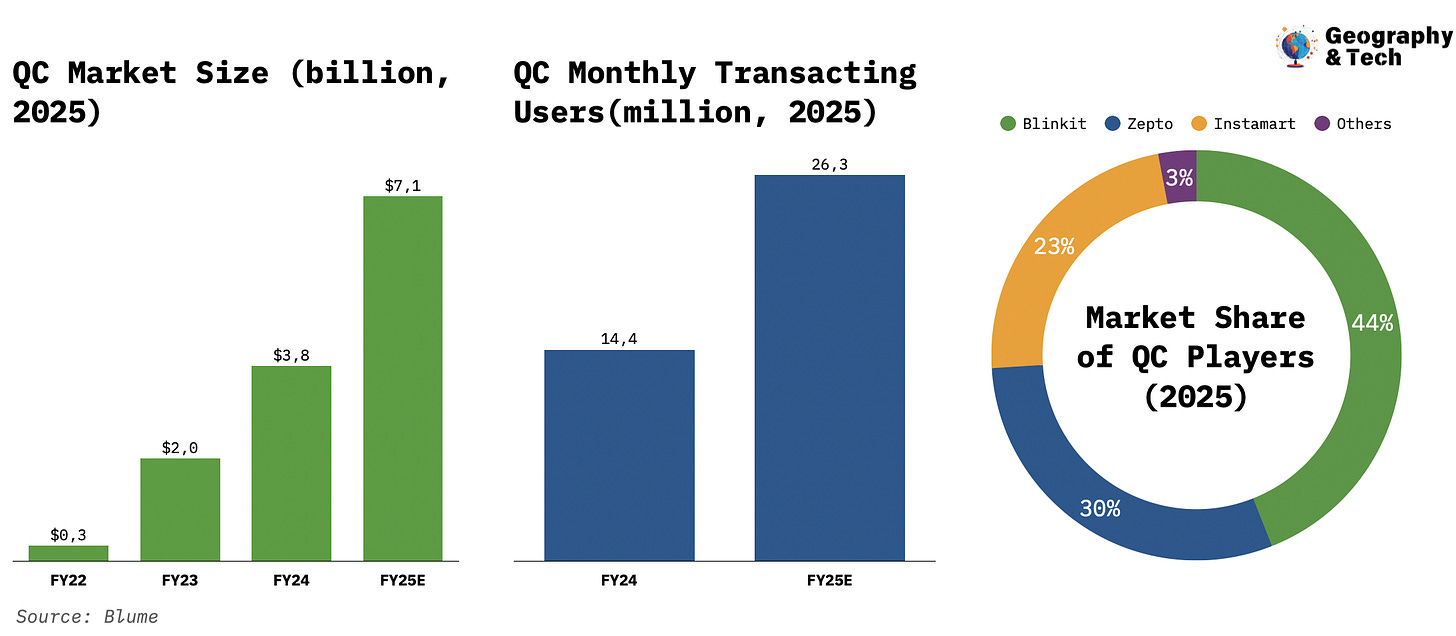

24x market growth in 3 years—The quick commerce market is already at $7.1 billion. I don’t think I’ve ever seen a single-country market that’s growing at 100%+ annually, is over $1 billion in size, and is tied to the physical world.

Projected growth to $40 billion by 2030—That would mean the market will 6x in just five years.

Millions of new users trying quick commerce each year—A market expansion of 12 million in one year is massive, even for a country as big as India.

A major driver of online FMCG sales—Quick commerce accounts for 35% of online FMCG sales and over 50% of online food delivery.

And the runway ahead is enormous.

Right now, quick commerce contributes just 2-3% of total sales for most large CPG brands. Even by 2028, the industry is expected to capture just 3% of the overall FMCG market. Players are just starting to expand into other categories, like cosmetics and electronics. Most of the revenue is concentrated in a handful of cities—90% of Blinkit’s GMV comes from just eight cities. Meanwhile, Instamart and Zepto have been on the market for less than five years and have already crossed $1 billion in GMV.

The three companies mentioned above are defining the market: Blinket (44% share), Zepto (30%), and Instamart (23%). Importantly, Blinkit and Instamart are owned by Zomato and Swiggy, India’s leading food delivery platforms. That backing gave them an edge in distribution, financing, and rapid expansion.

And as you’d expect, all three are growing at breakneck speed.

The number of dark stores they operate has shot up from 985 in 2023 to 3,260 today. All three have expanded to 70+ cities—up from under 30 just two years ago. Blinkit now sees 40% of its GOV from non-food items, signaling further diversification.

They’re also diving deep into advertising—quick commerce ad revenue is now running at ~$400 million, or ~5% of GMV, and growing fast.

The model has become so dominant that it’s now expanding into other industries. I previously wrote about Snabbit, which applies the quick commerce model to house help. There’s also Blip (30-minute fashion delivery) and Plazza (medicine delivery).

The three quick commerce enablers

Now that we’ve established the industry’s insane growth, let’s break down why India is the perfect place for it to happen.

Factor #1 — India’s breakthroughs in digital infrastructure

India has led the world in building national-scale digital infrastructure under the Digital Public Infrastructure (DPI) framework—better known as India Stack.

India Stack is a set of digital layers enabling seamless identity verification, payments, and data exchange. Two core components:

Aadhaar (biometric ID system): Since launching in 2009, it has provided identity proof to 1.3 billion people. This allowed near-universal financial inclusion—bank account penetration jumped from 35% in 2011 to 77% in 2021.

Unified Payments Interface (UPI): An instant, real-time payment system enabling direct bank-to-bank transactions via mobile. Today, it powers 70% of digital payments in India.

ONDC is the next chapter in this story. What makes many optimistic about ONDC’s prospects, is that Aadhaar and UPI weren’t the only successful initiatives. For example, Government e-Marketplace (GeM), a public procurement platform, has reached 5.9 million sellers. The Digital Infrastructure for Knowledge Sharing (DIKSHA) covers 200 million students in 1.48 million schools.

Another part of the story is the role of private companies in developing digital infrastructure, specifically Reliance Jio. A part of India's leading conglomerate, Reliance, Jio was launched in 2016 and in just two years provided cheap 4G internet access to over 200 million users.

India went from being among the laggards in digital infrastructure quality to being a pioneer in vertical and horizontal digital inclusion in less than a decade.

Factor #2 — India’s growth story

As the most populous country on the planet, India has two things going for quick commerce: dozens of cities with population of over 1 million people, and a high population density. According to the Indus Valley Report, top Indian cities have 14,775 people per sqm density, compared to 3,792 in top global cities, like Tokyo or New York City.

India's middle class is growing rapidly: from 349 million in 2016 to 432 million in 2021, and is projected to reach over 1 billion by 2047. The number of those considered rich is going to increase from just 37 million in 2016 to 437 million in 2047.

But the growth has been uneven. 12.3% still live in extreme poverty. The job market is characterized by lack of opportunities for the educated and a predominantly non-formal demand. These factors suppress wages, with riders both costing less than in neighboring developing countries and constituting a smaller percentage of the GOV.

Factor #3 — Kirana stores as quick commerce precursors

Kirana stores define India's retail story. The numbers vary, but most sources cite 13 million—that's how many kirana stores there are in India. They contribute 10% of GDP and employ 8% of the workforce. 70-80% of all FMCG sales go through kirana stores.

What quick commerce, or even e-commerce in general, offers today, kirana stores have been offering for decades. KiranaPro's founder, Deepak Ravindran, like millions of other Indian kids, was a delivery boy for his grandfather's kirana store. They offered credit before anyone even heard the word BNPL.

Indian consumers are used to quick delivery of essential goods more than probably any other nation in the world.

The difference today is that quick commerce does it better. At least the quick commerce players think so.

The Roadblocks

Which brings me to the risks for KiranaPro. And I’ll start with the risks so we can finish on a positive note, discussing how and why KiranaPro can succeed despite them.

Quick commerce has real advantages over kirana stores

KiranaPro’s model relies on a single kirana store fulfilling each order. But that store carries 4-6 times fewer products than a dark store. Unlike offline shopping, where you can visit multiple stores in one trip, you have to hope that a single kirana store has everything you need.

Additionally, kirana stores don’t operate 24/7 like dark stores, meaning they miss out on nighttime orders.

Another key difference is sourcing. Kirana stores buy from distributors, who in turn work with manufacturers. Quick commerce players, thanks to their scale, can go directly to manufacturers, allowing them to offer lower prices.

As a result, 66% of quick commerce buyers say they prefer these services due to lower prices, exclusive deals, and a wider product selection compared to kirana stores.

Not all kirana stores are created equal

Kirana stores are family-owned small businesses. These 13 million independent entities all have their own quirks, strengths, and weaknesses. Some store owners are highly efficient—they manage inventory well, follow customer trends, and build strong relationships. Others, not so much.

This creates an inconsistent customer experience. And while customers don’t interact with the store directly when ordering online, they still feel these inconsistencies—maybe their order is delayed because the owner was too slow to pack it, or maybe they weren’t paying attention and forgot to include the flour.

Most kirana store owners also lack experience in fulfilling online orders. Until sell-side apps on the ONDC platform improve to smooth out these rough edges, the experience will remain uneven.

Everyone’s entering the quick commerce market

Many well-capitalized players want their slice of the quick commerce pie. Amazon is launching a quick commerce app called Tez. Flipkart already has Minutes, a service delivering goods in under 30 minutes. Tata’s BigBasket and Reliance’s JioMart have both transitioned to quick commerce. The competition is heating up fast.

Quick commerce’s additional revenue streams

I’ve already covered the advertising business part, but quick commerce players are also launching private labels, which presumably have much higher margins. Combine that with the fact that ad revenue has crazy margins, and they have plenty of capital to fuel further expansion.

Closing kirana stores

Last year, 200,000 kirana stores shut down. Yes, 90,000 of those were in metro cities, where quick commerce dominates. But another 110,000 were in smaller cities, suggesting that other factors might be contributing to kirana store closures.

Reliance on ONDC

I don’t think this is a major risk, but it’s worth mentioning that there’s a chance ONDC doesn’t scale enough to make businesses on its platform profitable. Without ONDC, KiranaPro wouldn’t exist in its current form. That said, I don’t see this as a significant threat.

Voice search replacing traditional catalogs

I saved this one for last, but I actually think it’s the biggest risk.

Ordering online isn’t new. Ordering from kirana stores isn’t new. Even ordering online from kirana stores isn’t new. What is new is ordering using voice search only. And from reviews, we see that the experience isn’t quite there yet.

Changing consumer behavior is hard. Even if voice search worked perfectly, I’m not convinced it would be the preferred ordering method. When you factor in India’s linguistic diversity and wide range of accents, the challenge becomes even greater.

The risk is somewhat mitigated by the fact that 40% of searches in quick commerce apps are for specific products. But still.

If I had to bet, I’d say KiranaPro will eventually introduce traditional search. It’s easier to monetize, more familiar to users, and just works.

The Upside

All of the risks above seem like major challenges. And they are. But I wouldn’t have spent dozens of hours researching and writing this article if I didn’t believe in the company’s potential. So here’s why I think KiranaPro could work.

There’s enough for everyone

There’s so much space in the market and so much growth ahead that multiple players will find their niche.

All the big quick commerce players—and new entrants—will battle it out in India’s largest cities. These cities have the highest-spending consumers, frequent orders, and the ability to absorb rising commissions.

But there’s also a massive, less glamorous market in smaller cities, where population density is lower, and order frequency and AOV are not as high. You could argue that quick commerce players haven’t expanded there yet, but I’d counter that expansion for expansion’s sake isn’t smart. Entering 200 cities but only making 10 profitable doesn’t make sense.

That’s where KiranaPro is focused.

Loyalty

While researching this piece, I found that many sources noted how kirana stores are deeply embedded in their communities. They occupy a special place in Indian culture—you can buy 100 paper plates and return the unused ones. That doesn’t happen in any other retail environment.

One article put it best:

Supermarkets have loyalty programs, but at a kirana shop, loyalty is rewarded with free advice on everything from politics to parenting.

In general, Indians are very loyal consumers. This is probably why 34% of people still prefer offline shopping.

So no matter how fast quick commerce grows, kirana stores will always have a place—just by virtue of tradition. In a country of over 1.4 billion people, that’s a lot of loyal customers.

Government support

ONDC is a government-led initiative aimed at democratizing commerce. In other words, the government wants kirana stores to succeed.

With just 5-6% of small businesses selling online, the potential market is massive. ONDC also offers commission rates that are 25-50% lower than dominant platforms, meaning consumers recoup some of the savings lost due to kirana stores’ higher prices.

Plus, politically, letting kirana store owners—13 million voters—fail wouldn’t be a smart move.

A long way to fall

Kirana stores still control 92.6% of India’s grocery market. That share is projected to drop to 88.9% by 2028.

Yes, when you look at consumer trends and projections, the outlook seems bleak. But kirana stores have such a massive lead that predicting their demise is premature at best, and flat-out wrong at worst.

Kirana stores are ready to digitize

80% of kirana store owners say they need to go online. 84% have already adopted some form of digital technology.

The Takeaway

This is a typical David and Goliath story—an upstart disrupting a multi-billion-dollar industry. A company trying to capitalize on one set of primitives (government-led digital platforms, established supply, cultural relevance, etc.), while the competition bases its thesis on another (growing urban population, continued rise of the middle class, reaching scale, etc.).

In the end, as I said, I think both have a tremendous opportunity ahead of them, and both can win at the same time.

Also—and this is very obvious, but still—every business comes down to your ability to acquire and retain customers. The more differentiated and defensible your strategy is, the higher your chances of success. In this sense, KiranaPro is a very pure business: it focuses on the most important thing with a clearly defined and differentiated strategy.

Gr8 article.. I really enjoyed this informative and well researched piece. The idea of disrupting such a large market might seem daunting but I wish Kiranapro team all the best of luck... Local is better 👍🏽