Skor: Bringing Credit Solutions to Indonesia — 🌎 Issue #22

Tapping into a potentially giant market.

Hello dear reader,

It’s Tuesday, and today I’m diving into Skor Technologies—a company taking on Indonesia’s emerging credit market.

Skor Technologies, an Indonesian fintech company, has raised $6.2 million in a pre-Series A round led by Argor Capital. QED Investors, Saison Capital, and Digital Currency Group also participated in the funding.

The Product

Skor Technologies offers two primary products: Skorlife and Skorcard.

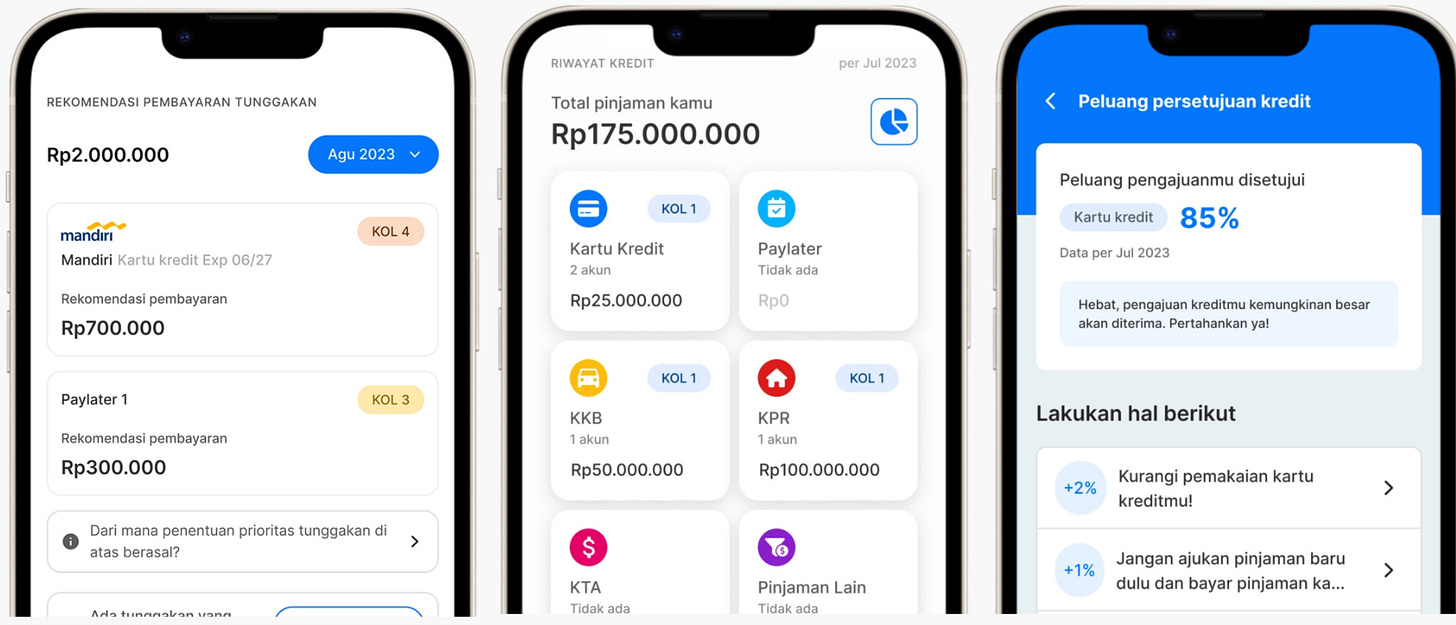

Skorlife is a platform designed to give users access to their credit scores and reports. It helps customers dispute inaccurate information, build a credit history, and offers tailored recommendations to improve credit scores. Users can also see what factors impact their score and even get a prediction of how likely they are to be approved for loans.

Co-founder Ongki Kurniawan notes that while financial institutions hold significant data on users, individuals often lack access to their own credit information. Skor bridges this gap.

Meanwhile, Skorcard, launched in 2024 in partnership with Bank Mayapada International, is a gamified, digital-first credit card aimed at younger consumers. Rewards are the centerpiece of Skorcard. Customers earn points based on the type and size of their transactions—think 25,000 points for shopping with five online retailers in 30 days or 100,000 points for refueling four times with $30 each. These points can be redeemed for flight tickets or used to offset card balances.

The Business Model

Skorcard generates revenue through five types of fees:

Annual Fees: ~$18, starting from year two.

Interest Rates: 1.75% per month.

Repayment Charges: Up to ~$6.

Transaction Fees: Ranging from 3.5% to 6%.

Service Charges: For services like notifications or card replacements.

Currently, Skorcard handles $10 million in annualized spending and aims to hit $100 million in transaction volume by 2025, with a target of 2 million users.

As for Skorlife, it remains a free product for now. However, with over 2 million downloads, monetization opportunities are likely on the horizon.

The Local Angle

Indonesia’s economy is at an early stage of financialization, presenting significant opportunities for fintech companies like Skor:

Limited Access to Credit: A staggering 7 out of 10 Indonesians get rejected when applying for a loan. Worse, many don’t know why they were rejected, leaving them stuck in a frustrating cycle with few options to address the issue. As a result, people often turn to alternative solutions like pawnshops, peer-to-peer lending, or buy-now-pay-later (BNPL) platforms—all of which come with significantly higher interest rates. Compounding the issue, accessing one’s credit history is cumbersome. You can either request it from the Indonesian Financial Services Authority, which is time-consuming, or pay a credit bureau, which adds an unnecessary financial burden.

No Debt, No Growth?: With a household debt-to-GDP ratio of just 16.5%, Indonesia is among the least indebted countries globally. While low debt levels might sound like a good thing, access to credit is essential for enabling individuals and businesses to invest in the future. Studies, suggest that debt can boost economic growth, at least in the short term. For Indonesia, the challenge lies in fostering responsible borrowing while educating the population on the benefits of credit when used wisely

Low Credit Card Usage: Only 1.6% of Indonesians own a credit card—a number that’s startlingly low, even by developing country standards. Credit card adoption tends to correlate with economic development, as over 40% of people in most developed countries use them.

Financial Fraud Concerns: Financial crime is an issue in Indonesia, which ranks high on global financial crime indexes. 64% of Indonesians have reported being targets of fraudulent financial communication, and 49% know someone who’s fallen victim to scams, according to FICO. While Skor is not explicitly a fraud prevention platform, it incorporates features to protect users, such as alerting them if a loan application is made in their name without their consent—an essential safeguard in a market plagued by fraud.

The Roadblocks

I think every financial services business faces similar risks. But still, we do have to point them out.

Regulatory Environment: Indonesia’s regulatory framework struggles to keep pace with innovation in fintech. Skor has already experienced friction with regulators. In its early days, the app was suspended for five months due to government concerns about how it handled user data from its rapidly growing base of 150,000 customers.

Cultural Tendencies: In the 1980s, over 60% of the population lived in poverty, and credit was largely irrelevant to most people’s lives. Fast forward to today, millions of Indonesians have disposable income, but many lack experience with credit or even basic financial concepts—only half of the population understands them. Add to this Indonesia’s status as a low-trust society, and convincing people that credit is safe becomes a tough job.

Default Risk: Credit-based businesses are inherently risky. For example, BNPL platforms in Indonesia report default rates of 6.8%, more than double the 2.4% default rate of banks. This is particularly concerning because young people—a demographic that Skor heavily targets—make up half of BNPL users.