The Box, a Dubai-based self-storage company, raised $12.5 million in debt financing from Shorooq. Although I usually write about up-and-coming startups, I decided to make an exception—when’s the next time I get to write about physical storage?

So let’s dive in.

The Product

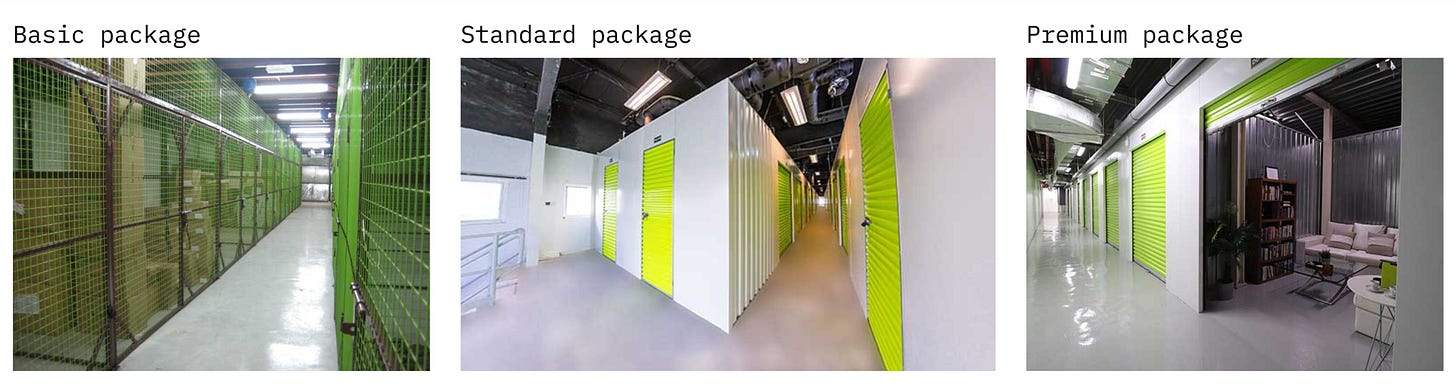

The Box’s first and main product is self-storage spaces, with 30 facilities spread across the UAE. These spaces range from compact 16 sq ft personal lockers to expansive 3,000 sq ft “mini-warehouse” units. There are three package options, each offering a different level of amenities—the more you pay, the more you get. Those packages are:

Basic—includes essentials like air conditioning, CCTV, security, and pest control.

Standard—adds a sprinkler system, 24/7 access, and upgrades the unit from a cage-style room to a dedicated storage space.

Premium: going for premium gets you access to storage-related services, like an elevator or a 3 gate loading bay, and things that have nothing to do with storage, like a cafeteria, a lounge are, and a co-working space.

Once you’ve picked your unit size and location, you can customize your setup with add-ons. Need a padlock or some racks? No problem. Want insurance or help transporting your stuff? That’s available too.

And speaking of moving, The Box handles that as well. Their moving service is separate from storage, so whether you’re relocating or just need temporary space, they’ll pack up your things and transport them wherever they need to go.

That’s it for the consumer side.

On the B2B side, The Box goes beyond storage.

First, they rent out the assets they already have: businesses can book a forklift or hire manpower by the hour. Second, they offer fulfillment services for e-commerce stores, covering everything from packaging to delivery. The pitch is simple: they have the space, the manpower, and all the approvals to run a warehouse. If you’re an e-commerce business that doesn’t want to deal with logistics, The Box is happy to take care of it.

The Business Model

The B2C and B2B models are distinct. The B2C offering has transparent pricing—you can figure out how much you’ll pay for storage without leaving The Box’s website. Also, while The Box became the biggest player in the industry largely thanks to its B2C product—which contributes 80% of the company’s revenue—the B2B side is what makes it unique.

B2C

The B2C business works as you’d expect.

Your storage payment depends on three factors: how much space you rent, for how long, and which package you choose. Prices range from $100 a month for a 12 sq ft space to $600–$700 for a premium 200 sq ft unit, with plenty of options in between.

Complementary services (probably the highest-margin part of the business) can add up fast—$170 for a storage rack here, $130 for insurance there. Maxing out the storage size and options could get you to around $10,000 a year, though most customers will pay far less.

For moving services, pricing depends on how much stuff you have—the more there is to pack and move, the higher the cost. They’ll also sell you a box, which is probably their most profitable product.

B2B

Now, the fun part.

Yes, there’s the standard business storage offering, but unlike the consumer side, pricing is custom. The basic premise is the same, but businesses negotiate their rates.

What’s interesting is how The Box leverages its core asset—storage units—to compete in an entirely different space. A traditional storage company wants customers to store things indefinitely.

But The Box’s biggest cost is CapEx: buying land, constructing storage units, and equipping facilities with security systems, climate control, and management tech. So the real incentive is maximizing space utilization—renting out as much space as possible, whether for a year or just a month. And this is where the e-commerce fulfillment play makes so much sense.

Yes, they have additional costs—trucks, delivery staff, a tech backend—but that’s still cheaper than building 30 new warehouses.

By layering on e-commerce logistics (storage + pick/pack/deliver), The Box turns passive storage into an active revenue source. This increases yield per square foot, especially in areas with high e-commerce density.

If you own one giant warehouse in the middle of nowhere, you only compete on storage. But if you have distributed warehouses—especially near customers—you can also handle last-mile delivery. That makes your storage offer more attractive because you’re now a one-stop-shop, which improves margins and increases operational leverage.

You could argue delivery is more about operating costs than fixed costs, but we’ll get into that in the roadblocks section.

The Local Angle

People and Companies Need More Space: Rents for warehousing space continue to rise, driven not just by economic growth but also by the changing economic composition and the continued shift towards non-oil industries. The non-oil sector has reached 75%, up from 70% in 2020, with transportation and storage being the biggest contributor to that growth. Dubai’s population is consistently growing at over 3% a year. As in practically every other country, e-commerce has been steadily expanding, with growth exceeding 7% according to multiple sources. The number of companies operating in the UAE grew by 4% in the first nine months of 2024. You get the point: everything even somewhat related to storage is growing, and not at a snail’s pace. That’s why occupancy rates are close to 100% despite new infrastructure being built and despite Dubai being the 7th most expensive warehousing market in the world.

Expats Helping Drive the Market?: Here’s why I think expats are an important component of the storage market story. The number of rental transactions is growing, particularly in the studio/1-bedroom segment. Rent prices have risen 18% in just one year. With continued pricing pressure, some people have to either move to a less prestigious area or settle for a smaller apartment—meaning they’re moving excess stuff into storage. There’s also something to the idea that expats may transform their apartments depending on their family situation. Say someone rents a two-bedroom apartment, with one room functioning as a gym/home office when no one is visiting and as a spare bedroom when family comes over. With 22% of residents having family over during the summer alone, that may very well be an incremental growth lever for storage companies.

Escaping Summer: As you may have heard, Dubai’s summers are quite hot. So people leave. More specifically, 35% leave for a month or more. There’s also some anecdotal evidence that expats fly out of Dubai for an extended period during summer (here or here). These are not high-margin clients, since they rent for a short period, but there’s probably a sizable demand influx between June and September.

The Roadblocks

Economic Downturn: I always say that I don’t want to focus on things that can affect every business, like competition or economic slowdown. In this case, I’m making an exception because, at the end of the day, storage is a commodity business. You can add all the ancillary services you want, but ultimately, it’s still storage. And as a commodity business, it’s hard to raise your margins above the market median. If there’s a downturn, commodity businesses suffer the most. Storage providers are hit on two fronts: margins are already slim, and demand from all sides shrinks—people buy less (and store less), businesses produce less. That risk is even higher when you’re carrying debt.

Attacking Two Markets at the Same Time: The storage business and the fulfillment business may use the same infrastructure, but they have fundamentally different cost structures. So the question is: is The Box’s fulfillment solution profitable on a unit economics basis, or does it need scale to break even? If it’s not profitable yet, how much scale does it need—and does that growth come at the expense of the core storage business? It’s also unlikely that The Box will have a superior technological solution compared to specialized fulfillment players. Then there’s execution risk: fulfillment and logistics require different competencies—inventory handling, last-mile delivery, order accuracy—things that traditional self-storage companies aren’t built for.

The Takeaway

The thing I’m most interested in is how you juggle these two markets. How do you prioritize, execute, and scale? What trade-offs do you have to make to accommodate both businesses? We don’t know yet—but I guess we’ll see.